Meet the Achieve MoLO™ money app

Manage money, beat debt

Increase your money left over (MoLO) and tackle debt with a simple and free money management app.

4.6/5 stars

App Store rating

U.S. News

10 Simple and Free Budgeting Tools

30,000+

downloads and counting

Features you’ll love

The easy way to get ahead with your money

100% free, no ads

MoLO is for everyone— thriving or struggling. That’s why our app has no fees or 3rd party ads.

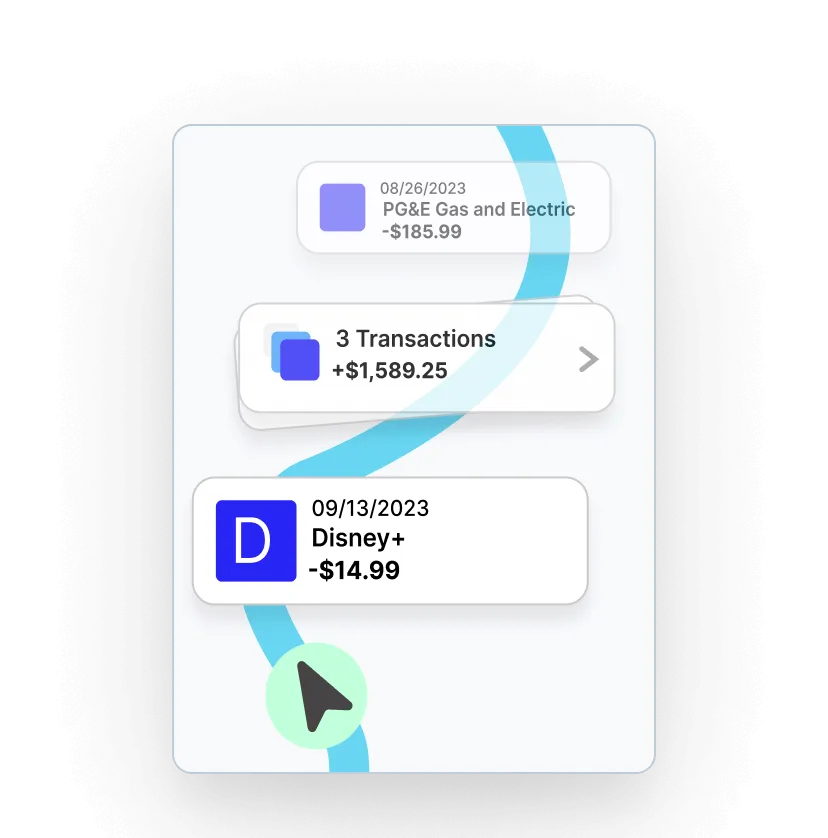

Accounts in 1 place

Connect all your accounts—bank accounts, credit cards, and more—to organize spending in categories.

Predict future transactions

View upcoming transactions, including paydays, recurring bills & charges, and subscriptions.

Secure & private

Your data is safe with us with read-only information. We don’t store passwords or sell your info.

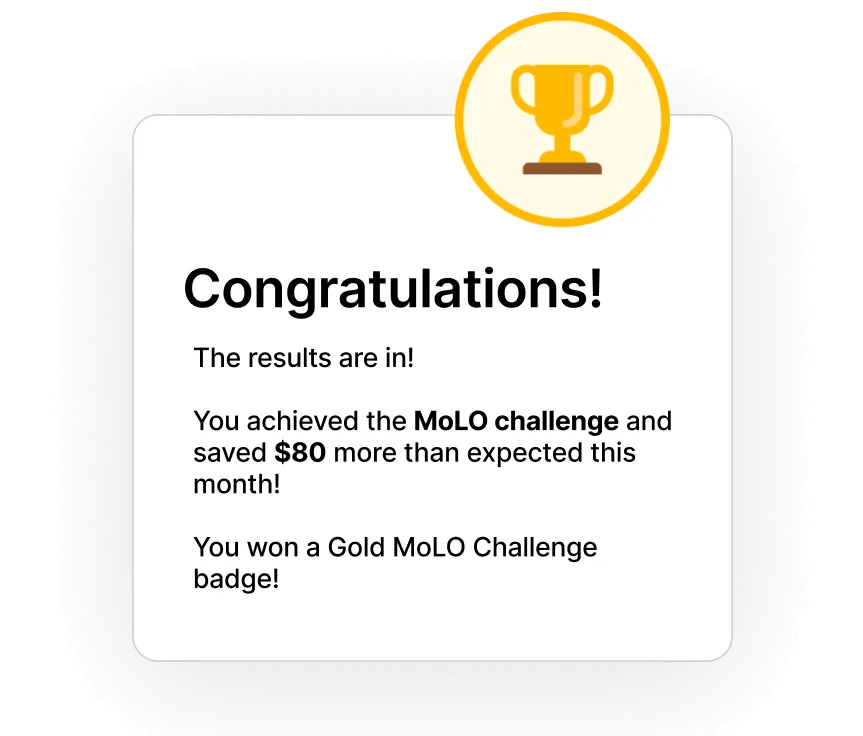

Spending challenges

Challenge yourself to decrease non-essential spending and increase your MoLO.

Just-in-time alerts

Get custom, insightful notifications for potential fraud, spending alerts, or monthly reviews.

MOLO MONEY APP BASICS

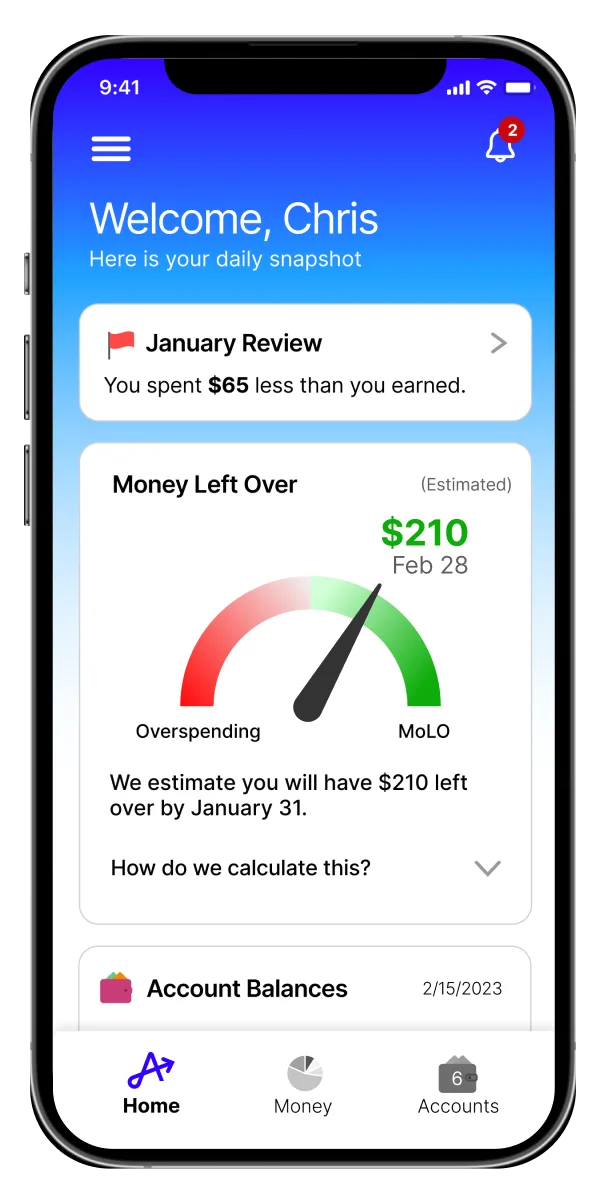

What does MoLO stand for? How does MoLO’s estimate work?

MOLO stands for “Money Left Over.” We think the foundational step in taking control of your financial future is to make sure you have money left over every month - that way, you can save money or pay down your debt. MoLO’s estimate is your expected income minus expected spending by the end of the month. It can change based on current month’s income and spending and past months’ income and spending trends.

Here’s how you can get started with MoLO:

Connect accounts: Connect at least one checking account and one credit card. Don’t worry, your information is protected by bank-level security.

Predict your MoLO: We’ll estimate how much money you’ll have left over at the end of the month so you’re confident about your next money move.

Boost MoLO & pay down debt: Once you know your whole financial picture, you’ll get personalized recommendations and insights to spend less and save more so you can use that money toward your goals like paying down debt.

Is MoLO free? How does the app make money?

MoLO is 100% free—no subscriptions or fees ever. That’s because MoLO is created by Achieve, the leader in digital personal finance. We make money through our other personal finance solutions. This allows us to build a free money manager app that stays true to our mission to help everyday people thrive by giving you personalized insights into your finances so you can get ahead every month.

By knowing more about your finances, you’ll have a better idea if you could benefit from one of our personal finance solutions designed to help our members debt relief and more. Learn more about Achieve and our personal finance solutions.

How is MoLO different from the other money apps on the market?

MoLO is simple, automated, and focused on helping you get ahead every month by having more money left over. Unlike other personal finance apps, MoLO is completely free from subscription fees and ads. When you connect your accounts we do the categorization and the math for you - no manual work!

MoLO

100% free, no subscription cost, no 3rd party ads

Predicts money left over each month

Features Money Checkup for 3-month trends & suggestions

Offers spending challenges to save more

Other money apps

Costs a download or subscription fee, displays ads

May not show a monthly estimate of money left after spending

May not offer historical trends or personalized suggestions

May not have custom spending challenges

MoLO FAQs

Is MoLO secure? How is my data protected?

When you give us your email and load your transaction data from your accounts, it’s encrypted and protected by bank-level security. We never store your bank passwords and MoLO doesn’t sell your information.

Why do I need to connect my accounts when I sign up?

MoLO tracks your money, including your savings and spending you would normally budget for, to find opportunities for money left over every month. When you connect your primary bank and credit card accounts, we use this read-only data to show your accounts in one place and do the math for you. With this data, we can analyze your usual spending habits and give you personalized insights so you can choose how you can spend less and save more.

How can I get ahead with my finances with MoLO?

We provide you our MoLO estimate based on your expected income minus expected spending as a simple way to see what you will have left over at the end of the month. You can “beat” your MoLO estimate by spending less or earning more than expected. This is a way you can challenge yourself to stay on budget and have more money left over compared to the previous month. Continue to build your money momentum so you can get in the habit of growing your savings to meet your financial goals.

What types of accounts can I add to MoLO?

You can add a variety of your accounts in our money management app to see a clear view of where your money is coming and going in one place, including

Checking and savings accounts

Credit cards and prepaid cards

Personal loans, car loans, and mortgages

Student loans and business loans

Retirement, brokerage and other investment accounts

The ability to add financial accounts to MoLO is dependent on a financial institution’s ability to share account information with our app. Most major financial institutions are available for connection.

How is MoLO different from the other money apps on the market?

MoLO is simple, automated, and focused on helping you get ahead every month by having more money left over. Unlike other personal finance apps, MoLO is completely free from subscription fees and ads. When you connect your accounts we do the categorization and the math for you - no manual work! While some apps may make recategorization a chore, you can effortlessly move your transactions to other spending categories in a second with a swipe.