Achieve Insights

California's Debt Dilemma: An Achieve Resolution Snapshot

Oct 30, 2023

Written by

Demand for debt resolution in California has increased 76% compared to 2020

In California, household incomes are growing and unemployment remains below prepandemic levels. But inflation, rising interest rates and the strain of unexpected financial hardships have left a growing number of Californians struggling with debt, according to a new study of consumer data by Achieve, the leader in digital personal finance.

Nationally, Achieve has found that rising incomes often obscure challenges many households face with debt. In the San Francisco Bay Area, consumer prices increased 3.4% annually in the most recent U.S. Bureau of Labor Statistics data and were up as much as 5.3% earlier this year. To further assess the local impact of this trend, Achieve analyzed its state-level data in California to examine how the profile of consumers who enroll in debt settlement has evolved since the pandemic.

The average household income of Californians enrolled in debt resolution was $57,285 through the first nine months of 2023, up 22% from 2020. However, the median FICO Score of debt resolution members in the state was 599 in 2023, down from 608 in 2020. While the typical debt resolution member in California is still within the “Fair” range of credit scores, this shift is indicative of the heightened strain these consumers face.

Download the California infographic

Likewise, the ratio of outstanding debt to total available credit on revolving accounts like credit cards — called the “credit card utilization rate” — was 74% in 2023, up from 70% in 2020. This shift mirrors the recent broader national trend of household debt levels growing to record highs and savings rates declining.

Achieve has helped over 1.5 million consumers resolve or consolidate over $24 billion in debt and offers a full suite of digital personal finance products and services to meet the needs of everyday Americans wherever they are on their financial journey. In a debt resolution program like Achieve Resolution, consumers with high levels of unsecured debt work with a team of experts who negotiate with creditors on their behalf, often settling their unsecured debt for less than they owe. Through the program, which takes an average of 24-48 months to complete, members can pay off debts faster and have more cash on hand after making one low monthly program deposit that is often less than the minimum monthly payments on their debts.

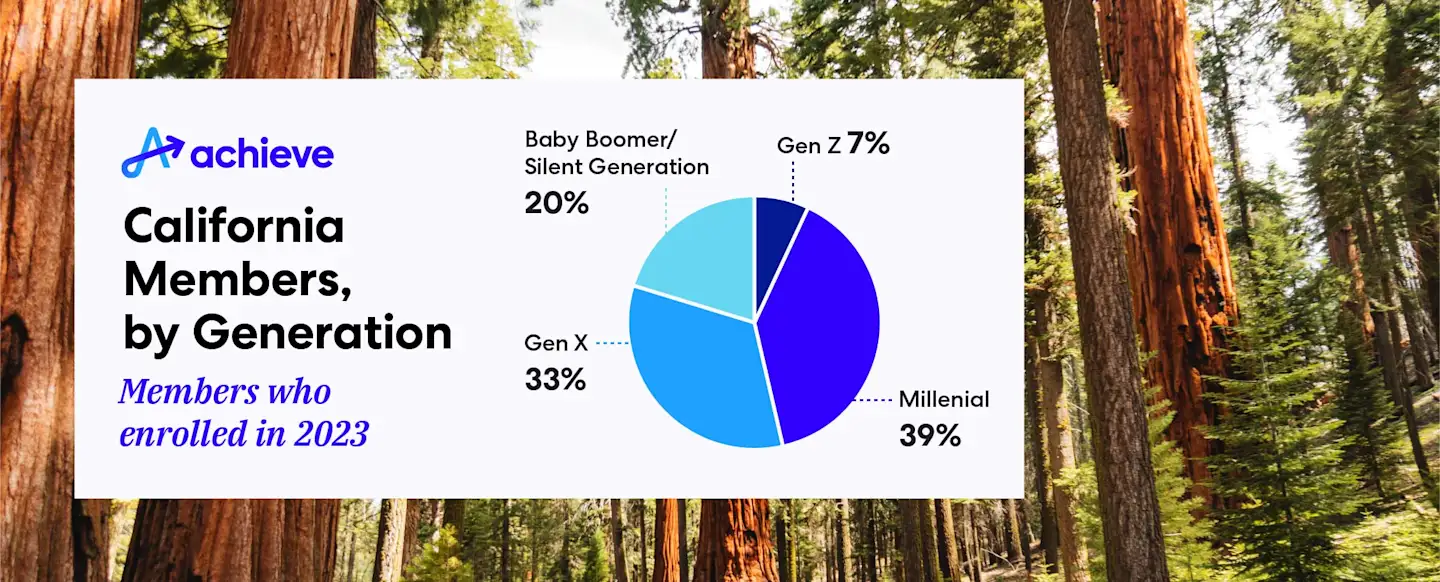

Achieve was founded in California and is headquartered in San Mateo. The company has seen consumer demand for debt resolution soar in its home state, with enrollment in debt resolution up 76% compared to 2020. The typical Achieve Resolution member from California enrolled an average of $25,920 in unsecured debt in 2023, down slightly from $26,674 in 2020. Another notable change is that the median age of California’s debt resolution enrollees was 43 in 2023, down from 49 in 2020. Achieve believes these shifts result from two factors: more consumers falling behind financially earlier in their lives and a stronger motivation to seek out help before debt problems worsen. This trend is further demonstrated by shifts in the generational breakout of Achieve’s debt resolution members.

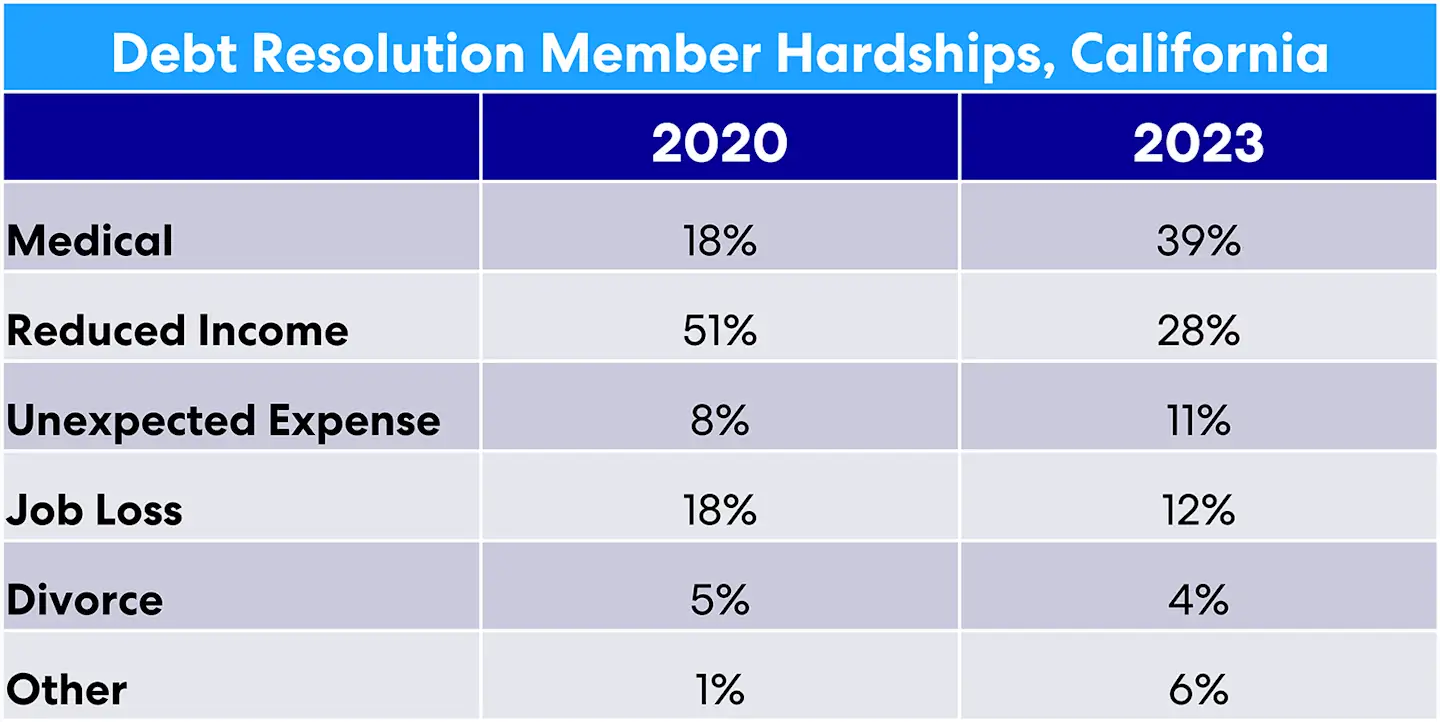

Consumers must have a demonstrated financial hardship to qualify for a debt resolution program like Achieve Resolution. Many consumers who enroll in debt resolution are getting by financially before a life-changing event like a medical issue or loss of income puts them in a situation they can’t recover from on their own. While income reduction was the leading hardship for California members in 2020, medical issues are now the predominant challenge for consumers who enroll in debt resolution.

The study was conducted by the Achieve Center for Consumer Insights, a think tank that publishes research and commentary in support of Achieve’s mission of helping everyday people get on, and stay on, the path to a better financial future. Other states featured in Achieve’s series of Snapshot Reports include:

Methodology

The data and findings presented are based on a representative sample of the over 200,000 active members enrolled in debt resolution products and services offered by Achieve and its affiliates. Annual comparisons are based on monthly averages for full-year 2020 and Jan.-Sept. 2023. To date, Achieve has served over 1.5 million customers and has resolved or consolidated over $24 billion in debt.

Written by

Analyst, Achieve Center for Consumer Insights

Related Articles

Americans in their 20s and 30s are becoming seriously delinquent on their credit cards at a faster pace than before the pandemic and approaching levels not seen since the Great Recession.

On the surface, the premise of Buy Now, Pay Later is simple and appealing. But borrowers who can’t afford to repay their BNPL loans risk getting hit with late fees, falling behind on other financial obligations, damaging their credit and other challenges.

With financial volatility on the rise, it’s time to rethink how people use mobile apps to manage their money

Americans in their 20s and 30s are becoming seriously delinquent on their credit cards at a faster pace than before the pandemic and approaching levels not seen since the Great Recession.

On the surface, the premise of Buy Now, Pay Later is simple and appealing. But borrowers who can’t afford to repay their BNPL loans risk getting hit with late fees, falling behind on other financial obligations, damaging their credit and other challenges.

With financial volatility on the rise, it’s time to rethink how people use mobile apps to manage their money