Return to Press Room

Cash-strapped Americans regularly have less than $50 in the bank, Achieve survey finds

Achieve launches Debt Fit™ Score financial assessment tool to help consumers struggling with cash flow and savings shortages

September 16, 2024

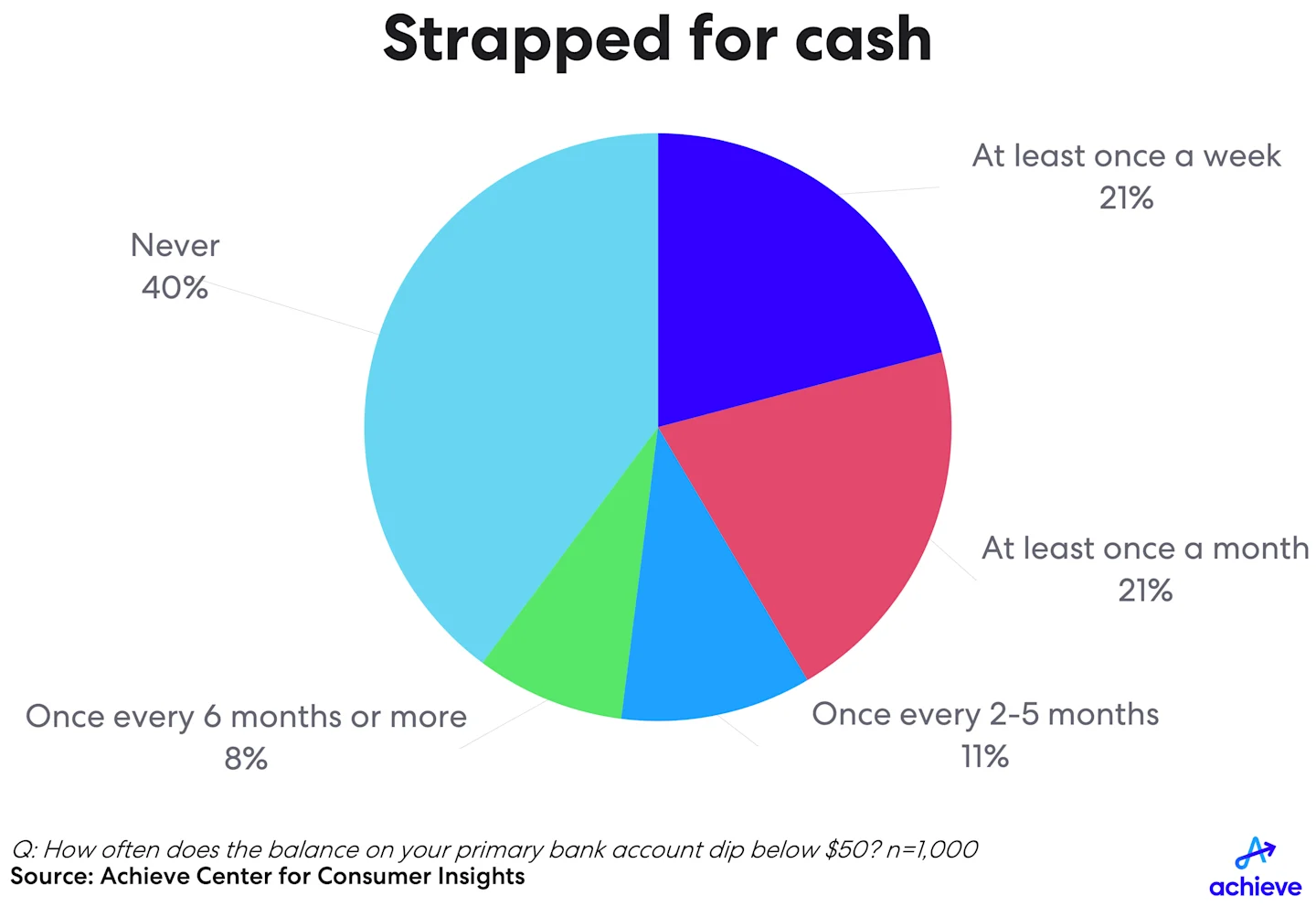

SAN MATEO, Calif. Sept. 16, 2024 — Household budgets are stretched so thin that 42% of consumers say their primary bank account falls below $50 at least once a month, while 30% have no financial backstop in case of a $5,000 emergency, according to a new study by Achieve, the leader in digital personal finance.

Among those with less than $50 in the bank each month, half — or 21% of all survey respondents — face a more perilous situation, as their bank accounts dip below $50 every week. Overall, Achieve’s survey found 60% of American consumers have less than $50 in their primary bank account a minimum of once every six months.

The survey of 1,000 consumers was conducted by the Achieve Center for Consumer Insights think tank. It highlights the precarious financial situation of many American households and the danger it poses when cash-strapped consumers are confronted with an unexpected expense or other financial hardship.

Among consumers whose primary bank accounts fall below $50 at least monthly, Achieve found that:

— 27% have a household income over $50,000, while 73% have household incomes below $50,000

— 43% of respondents are Millennials, followed by Generations X and Z (22% each) and Baby Boomers (13%)

— 70% have endured at least one major financial hardship in the past year

— 59% have over $1,000 in unsecured debt

Making plans for new expenses

Nearly half (48%) of all respondents said they need to plan ahead for a month or longer to prepare for a new $250 expense. This includes 17% who said they need three or more months to plan ahead. Meanwhile, less than one-third of respondents (31%) said they don’t need any time to prepare for a new $250 expense.

“For consumers living in this extreme paycheck-to-paycheck predicament, an emergency or unplanned expense can easily shift from minor inconvenience to major life disruption,” said Achieve Co-Founder and Co-CEO Andrew Housser. “When these situations arise, consumers who turn to credit cards and other debt to get by may experience stress, anxiety and other negative effects to their well-being.”

Emergency backup funds are lacking

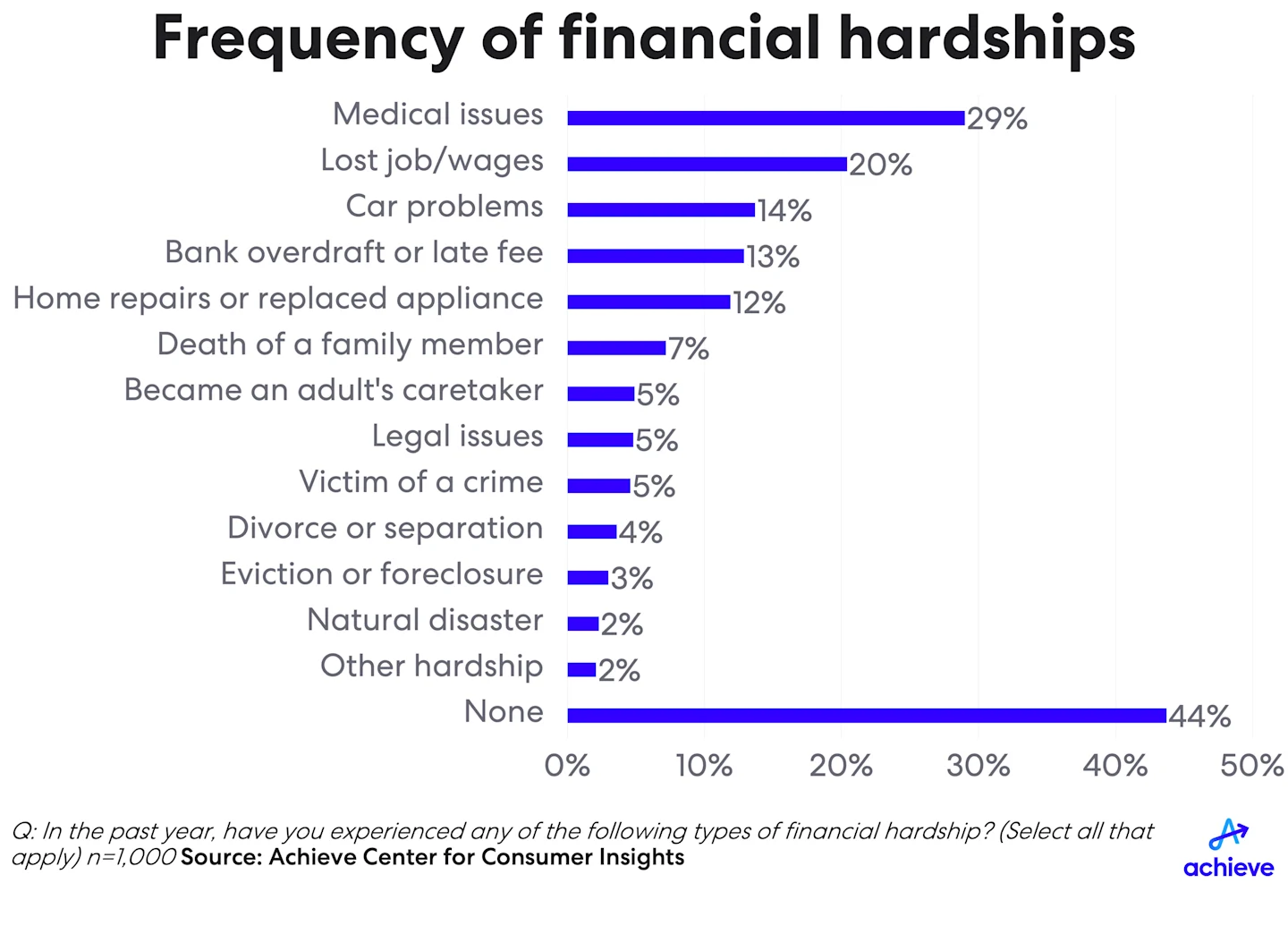

In addition to the tight day-to-day budgets of many households, 30% of consumers said they have no financial backstop they could turn to in the event of a major, $5,000 emergency. Others said they could turn to resources like their regular savings (31%), borrowing from family or friends (25%), or emergency savings (24%). Yet over half (56%) of respondents have experienced at least one major financial hardship in the past year, ranging from lost jobs, major home or auto repairs, natural disasters and medical expenses — including nearly one-third (31%) who have experienced multiple hardships.

How debt affects consumers’ health

The survey found 36% of respondents said their debt negatively affects their mental or physical health, while 41% of respondents said they worry they’ll never get ahead financially. From lost productivity at work to feelings of shame, exhaustion and depression, 60% of consumers said the repercussions of debt and other personal financial issues have spilled over into other areas of their lives.

American households owe a staggering $17.8 trillion in debt, according to the Federal Reserve Bank of New York, including over $1.1 trillion in credit card balances. Achieve’s survey found 30% of respondents have nearly maxed out their credit cards and other revolving debt, meaning they have less than 10% of their total credit limit available to use.

Credit utilization rate — the amount of outstanding revolving debt as a percentage of a person’s total credit limit — is a major component in credit score calculations. Achieve’s survey found 38% of consumers have a credit utilization rate at or below 30%, the threshold the credit scoring industry recommends consumers target to maximize their credit score.

Introducing the Achieve Debt Fit™ Score

The research was conducted to support the launch of Debt Care™ by Achieve, a new educational campaign that helps consumers understand and improve their debt health. The centerpiece of this initiative is the Achieve Debt Fit™ Score, a financial assessment framework that examines debt health and diagnoses areas for improvement.

The Achieve Debt Fit™ Score ranges from 0-100 to determine whether someone is in poor, fair or good debt health. Scores are calculated based on responses to a brief series of questions that align with four vital signs of debt health: debt, cash flow, risks and goals. Consumers can check their own Debt Fit™ Score by visiting achievedebtfitscore.com. The Debt Fit™ Quiz is free and does not require users to provide any personally identifiable information or email registration.

Based on data from Achieve’s survey, the national average Achieve Debt Fit™ Score is 56. Men have a slightly higher average Debt Fit™ Score, at 60, compared to an average score of 55 for women. Among all respondents, 28% have a Debt Fit™ Score in the Good range (67-100), while 64% have scores in the Fair range (34-66) and 8% are in the Poor range (0-33).

“Achieve has spent two decades helping everyday people reduce their debt, increase cash flow and move their finances forward,” said Housser. “The Achieve Debt Fit™ Score is an easy-to-use tool that provides a comprehensive view into the strengths and weaknesses of an individual’s debt situation, and it exemplifies our unique approach of offering personalized support backed by data-driven insights. The ultimate goal is to give consumers a simple view into their financial health and then help them take that first step toward achieving their goals.”

In addition to offering consumers the Debt Fit™ Quiz and other free Debt Care™ by Achieve resources online, Achieve intends to leverage the Debt Fit™ Score framework in future research and educational efforts to better understand the role debt plays in consumers’ overall financial situation.

Methodology

The data and findings presented are based on an Achieve survey conducted in June 2024 of 1,000 U.S. consumers ages 18 and older, and is representative of Census Bureau benchmarks of the U.S. population for age, gender, race and ethnicity.

About the Achieve Center for Consumer Insights

The Achieve Center for Consumer Insights is a think tank that leverages Achieve’s team of digital personal finance experts to provide a view into the state of consumer finances. In addition to sharing insights gleaned from Achieve’s proprietary data and analytics, the Achieve Center for Consumer Insights publishes in-depth research, bespoke data and thoughtful commentary in support of Achieve’s mission of helping everyday people get on the path to a better financial future.

About Achieve

Achieve, THE digital personal finance company, helps everyday people get on, and stay on, the path to a better financial future. Achieve pairs proprietary data and analytics with personalized support to offer personal loans, home equity loans, debt relief and debt consolidation, along with financial tips and education and free mobile apps: Achieve MoLO® (Money Left Over) and Achieve GOOD™ (Get Out Of Debt). Achieve has 2,500 dedicated teammates across the country, with hubs in Arizona, California, Florida and Texas. Achieve is frequently recognized as a Best Place to Work.

Achieve refers to the global organization and may denote one or more affiliates of Achieve Company, including Achieve.com (NMLS ID #138464); Achieve Home Loans, Equal Housing Lender (NMLS ID #1810501); Achieve Personal Loans (NMLS ID #227977); Achieve Debt Relief (NMLS ID # 1248929) and Freedom Financial Asset Management (CRD #170229).

Contacts

Erica Bigley

Vice President

Corporate Communications

415-710-9006

Austin Kilgore

Director

Corporate Communications

214-908-5097