3,000+

creditors we work with

44,000+

debts resolved each month

$140 Million+

in debt resolved each month1

HOW IT WORKS

5 simple steps to resolve your debt

REAL PEOPLE, REAL RESULTS

"Once I got started in this program, I felt that I finally found a path to the end of my debt. I finally could see a light at the end of the tunnel.”

— Melissa N.*, Achieve member who graduated from our debt relief program in approx. three years, three months

*Actual members. Members’ endorsement is a paid testimonial. Individual results are not typical and will vary.

"Achieve was easy to work with. It makes you feel so good that you have someone out there that can help.”

— Wanda A.*, Achieve member who graduated from our debt relief program in approx. one year, five months

*Actual members. Members’ endorsement is a paid testimonial. Individual results are not typical and will vary.

"Graduating from the program was a very up moment in life. My debt was gone.”

— Kevin C., Achieve member who graduated from our debt relief program in approx. three years, five months

*Actual members. Members’ endorsement is a paid testimonial. Individual results are not typical and will vary.

How it works FAQs

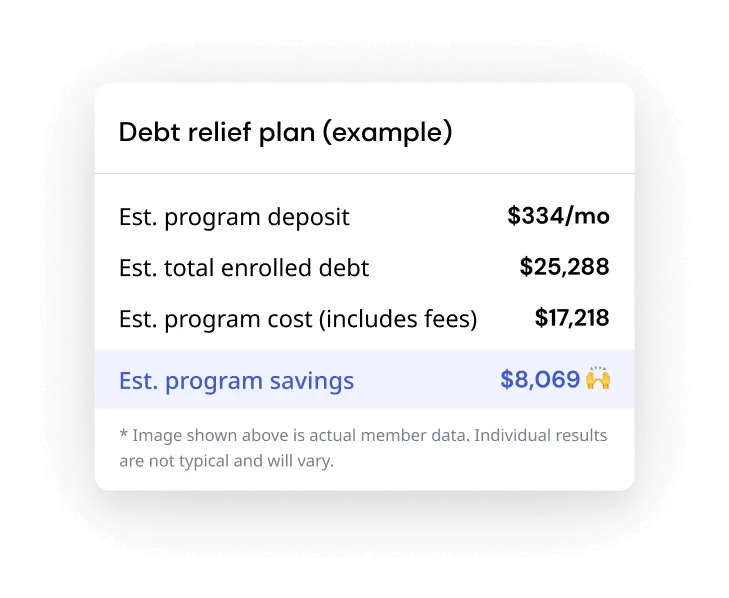

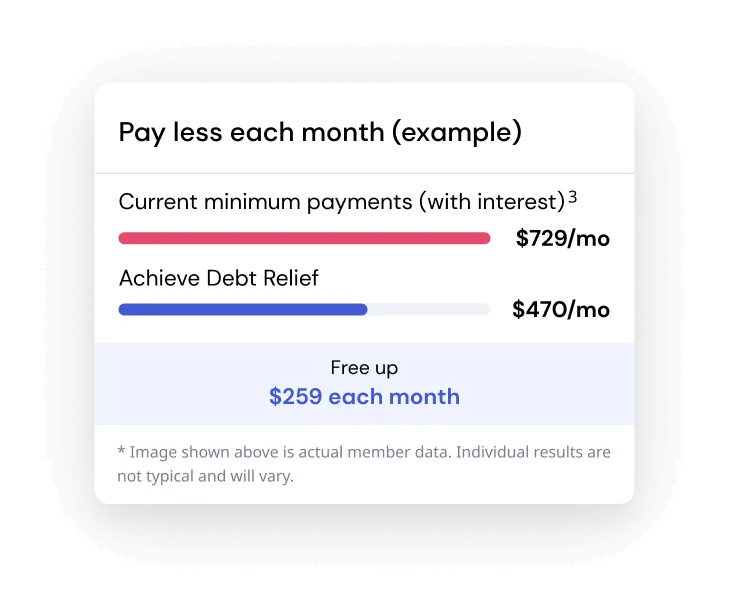

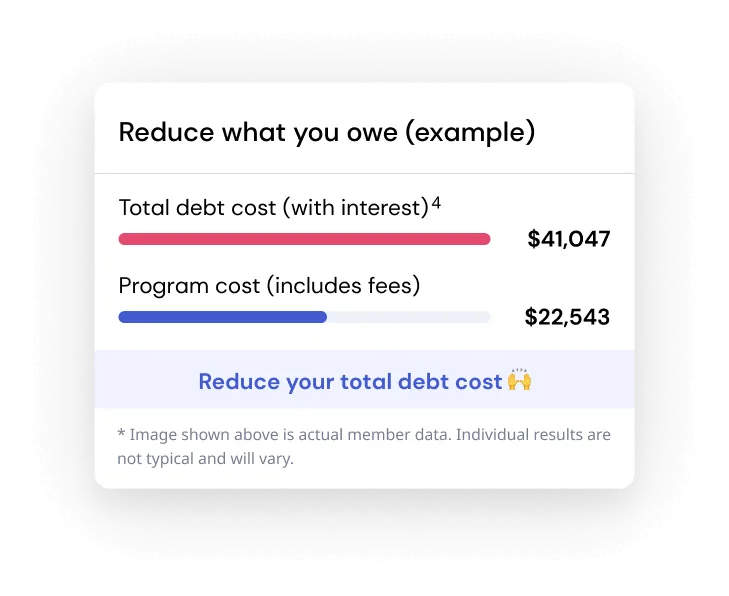

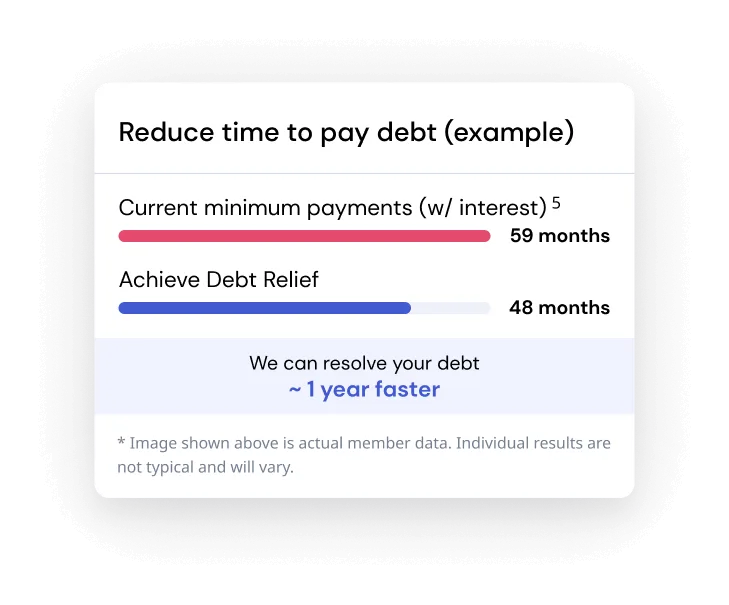

Achieve Debt Relief is a proven program where a team of experts work with creditors on your behalf to reduce the amount you owe. This allows you to pay off debts faster than making minimum monthly payments and keeps more money in your pocket.

Our debt relief program could help you with unsecured debts (debt not backed by collateral like a house or car). Debts we can help with:

Credit or department store cards

Most personal loans

Collections or repossessions

Lines of credit

Some payday loans

Some private student loan debt

Debts we can’t help with:

Taxes

Utility bills

Lawsuits

Secured loans (HELOC, auto, etc.)

Federal student loans

Not sure if your debt is eligible for the Achieve Debt Relief program? Get a free debt evaluation and find out.

Achieve Debt Relief helps consumers who have experienced a hardship (such as job loss, reduced income, unexpected expenses, medical debt, and divorce) and are struggling with unsecured debts, including credit cards, medical, department store and personal loan debts.

Our program is available in most of the country, but not in some states, including New Jersey. We enroll members with debt amounts between $7,500 and over $100,000. You could qualify for Achieve Debt Relief even with bad credit.

Program fees range between 15-25% of the amount of enrolled debt to be resolved. Rates may vary depending on your state of residence. There are no membership fees to join Achieve Debt Relief, only the monthly or bi-weekly deposit needed for debt negotiations and settlements.

As you stop payments to your creditors and your accounts go past due, your credit score may drop temporarily. However, as each account is resolved, those debts should be reported as such and should show a zero balance on your credit report, which should help your credit score begin to recover.

By the time you graduate from the program, you’ll be free of your enrolled debts.

Creditor calls

When you voluntarily stop paying your creditors, they will likely call you to collect payment. We have resources to help you deal with these calls. But as soon as we negotiate a settlement with them and you approve it, the calls should stop as you start making settlement payments to them.

Legal support

If your creditor takes legal action, you have access to legal support.

While we are not lawyers, we’ve partnered with a network of attorneys, the Legal Partner Network, that specializes in debt negotiation. The cost of this service is included in your program and available as long as you're making your deposits on time and in full.

Negotiations & settlements

Negotiation activity typically doesn’t start until you’ve saved up enough in your program account to make reasonable offers to your creditors. The first settlement typically happens between months four and six of a member’s program, but this varies greatly depending on your monthly deposit amount, the number of creditors you have enrolled in the program, and the balance of each individual account. Over 60% of members get their first debt settled in the first 3 months of enrollment.