At Achieve, we're committed to providing you with the most accurate, relevant and helpful financial information. While some of our content may include references to products or services we offer, our editorial integrity ensures that our experts’ opinions aren’t influenced by compensation.

Achieve Insights

Rising consumer debt is putting mental health in jeopardy

May 25, 2023

Written by

May is Mental Health Awareness Month, which creates an opportune time to explore the relationship between financial and mental health. For many people, financial security (or lack thereof) is fundamental to their ability to feel safe and secure, realize personal goals and aspirations, and maintain a healthy lifestyle. When that sense of security and well-being is put in jeopardy, it’s understandable that people may experience stress and anxiety that can escalate to more severe emotional distress and even physical health challenges.

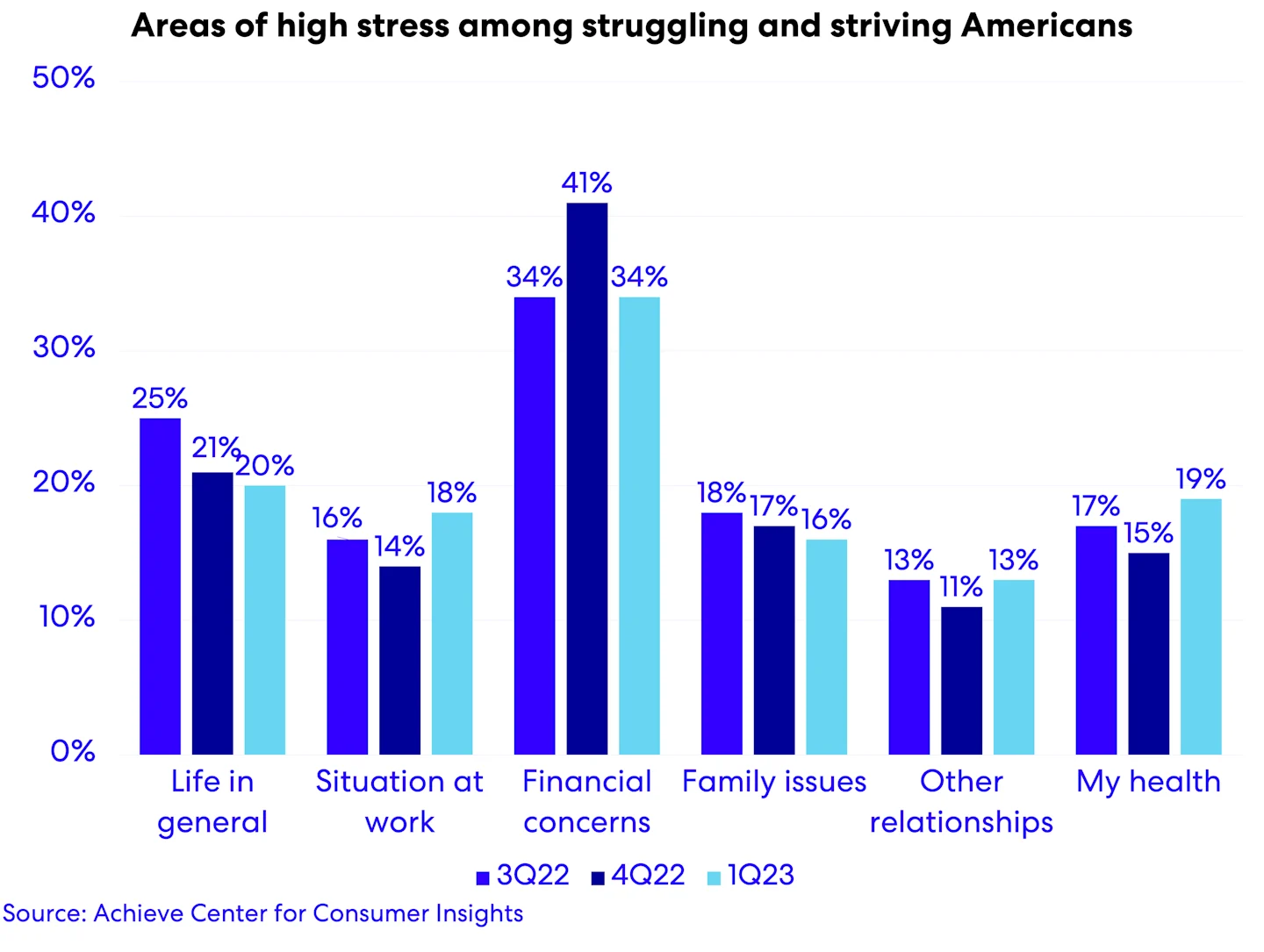

Achieve surveyed 1,000 consumers with at least $2,500 in unsecured debt and a credit score below 800. It’s a group we call the “struggling and striving,” and includes approximately 123 million people in the United States. Among this group, financial concerns are consistently the leading cause of mental stress, surpassing other stressors like family issues, professional challenges and life in general.

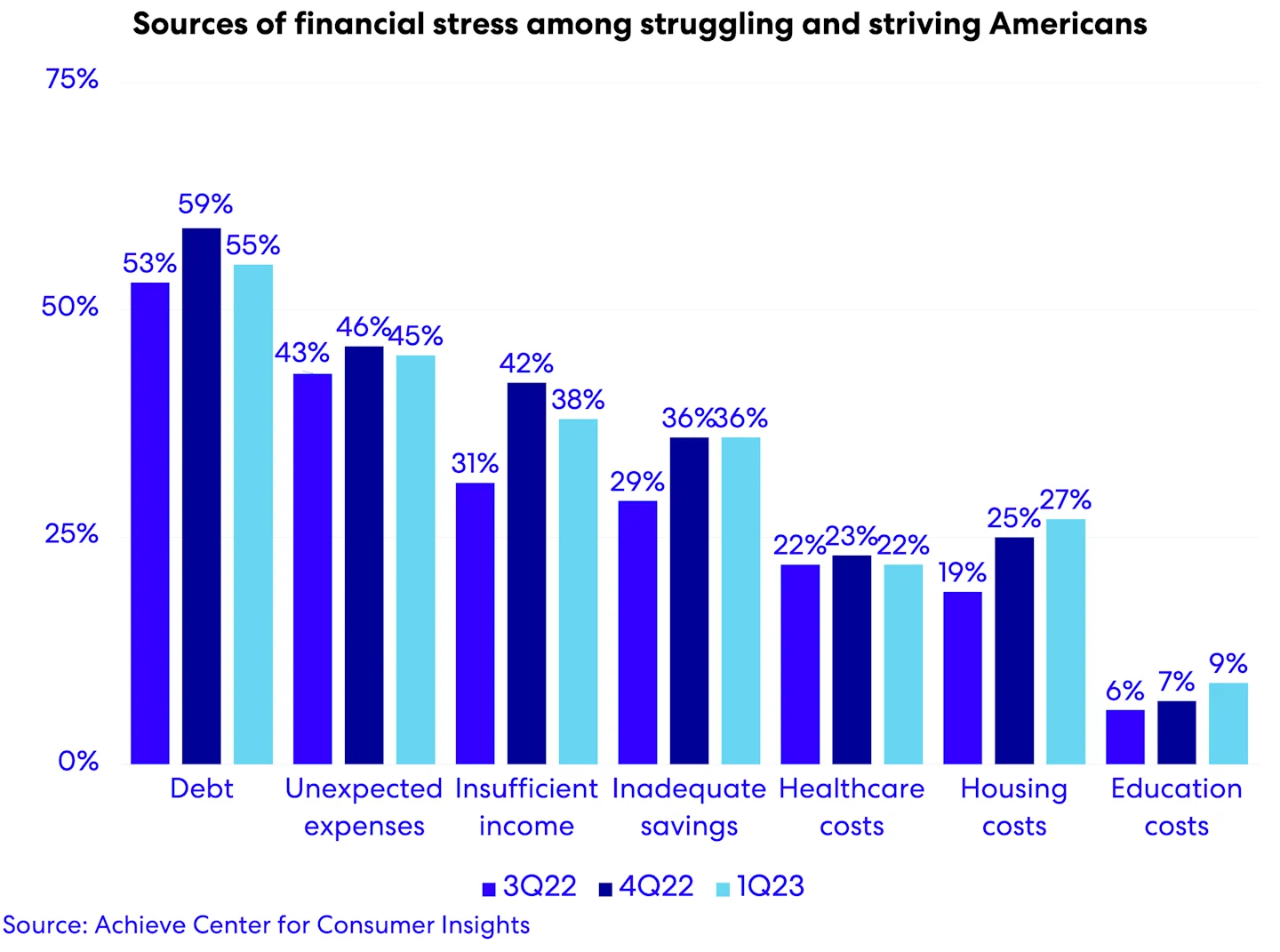

When asked about specific financial concerns that have resulted in financial stress over the past year, debt is consistently the most frequently cited pain point for struggling and striving Americans. Meanwhile, the cost of housing and education are both increasing sources of stress for this demographic, reflecting the shortage of affordable housing, rising interest rates for both mortgages and private student loans, as well as the likely end of federal student loan forbearances.

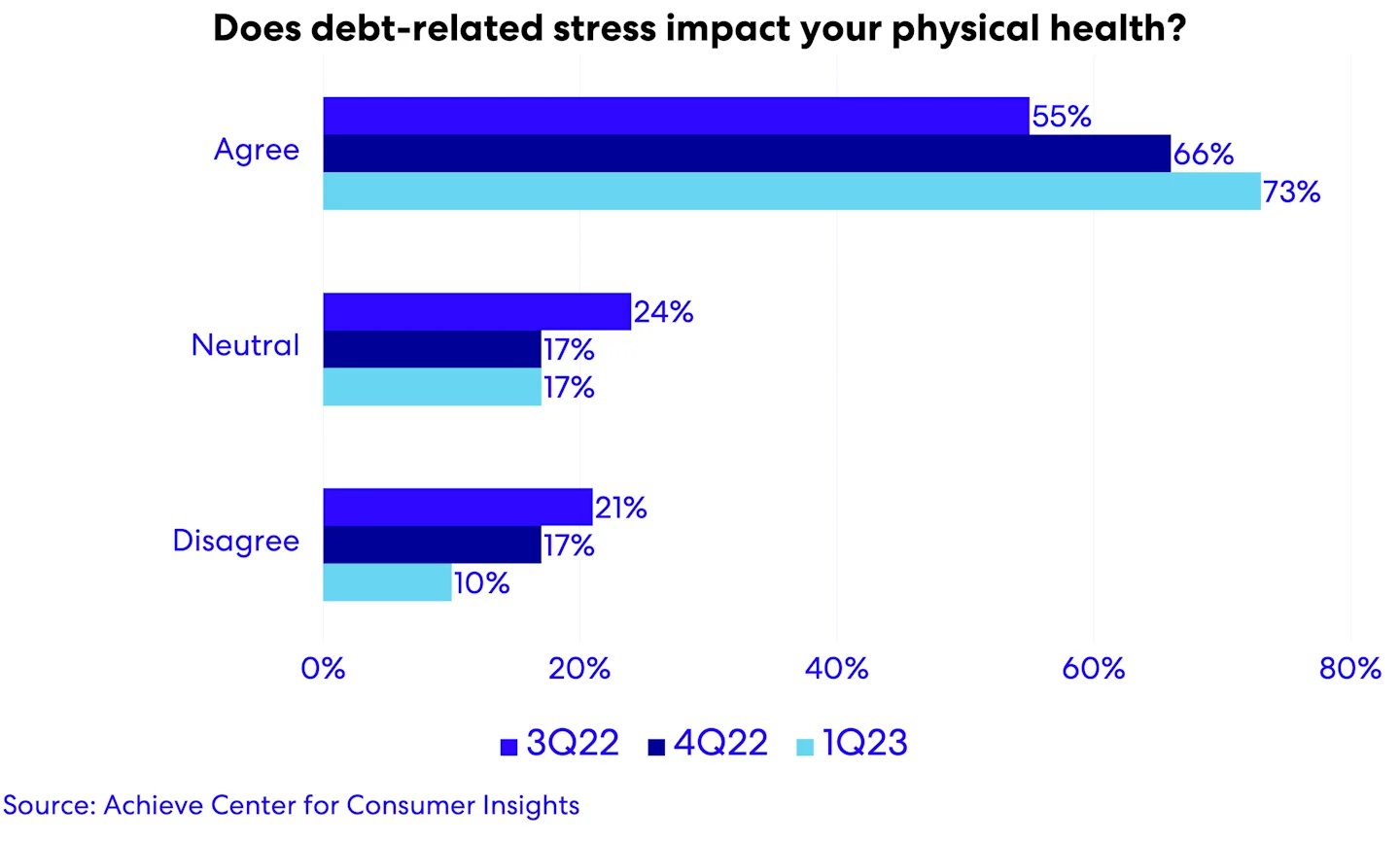

Total household debt rose by $148 billion, or 0.9%, to $17.05 trillion in the first quarter of 2023, according to data recently released by the New York Fed. Debt may often feel like a necessary factor in life, particularly in times of rising inflation and higher interest rates that’s making it harder for people to afford groceries and other basic necessities, let alone other discretionary purchases. So it’s not surprising that Achieve’s survey also found that debt stress is increasingly taking a physical toll on the struggling and striving population.

When trying to address personal debts, it’s important for people to not only create a plan for resolving their financial accounts, but also to seek out support and guidance on techniques that can help address bad habits and find ways to stay positive during what can be a challenging journey.

Author Information

Written by

Analyst, Achieve Center for Consumer Insights

Related Articles

Americans in their 20s and 30s are becoming seriously delinquent on their credit cards at a faster pace than before the pandemic and approaching levels not seen since the Great Recession.

On the surface, the premise of Buy Now, Pay Later is simple and appealing. But borrowers who can’t afford to repay their BNPL loans risk getting hit with late fees, falling behind on other financial obligations, damaging their credit and other challenges.

With financial volatility on the rise, it’s time to rethink how people use mobile apps to manage their money