At Achieve, we're committed to providing you with the most accurate, relevant and helpful financial information. While some of our content may include references to products or services we offer, our editorial integrity ensures that our experts’ opinions aren’t influenced by compensation.

Achieve Insights

Is a Gen Z Debt Crisis Looming?

Mar 08, 2023

Written by

Americans in their 20s and 30s are becoming seriously delinquent on their credit cards at a faster pace than before the pandemic and approaching levels not seen since the Great Recession. While serious delinquencies remain low overall, this trend is the result of a confluence of factors for which there are few easy solutions.

The data, from the Federal Reserve Bank of New York, is concerning for a number of reasons. Consumers across all age groups closed out 2022 setting a new watermark for household debt, driven in large part by the sharp rise in both interest rates and inflation that’s making it difficult for people to make ends meet and keep spending within their means.

But the problems run deeper among young consumers. Many younger adults didn’t benefit as greatly from the sharp rise in wages that resulted in the “Great Resignation” as much as people further along in their careers. More recently, unemployment among adults ages 20-24 was more than double the national rate in January, while unemployment among people ages 25-34 was 15% higher than the national rate.

Other contributing factors include scarcity in both the real estate and automotive markets that’s put affordable housing and transportation out of reach for many and across-the-board inflation that’s resulted in higher costs for all manner of domestic essentials. At the same time, the already high cost of childcare continues to increase for young families, a challenge compounded by capacity constraints and labor shortages at daycare facilities that can limit income and employment options for working parents.

While people of all ages and generations are dealing with these issues, younger consumers are more susceptible to falling behind because of them. Credit card issuers and other creditors tend to view people with limited or shorter credit histories as riskier, resulting in higher interest rates and lower credit card limits than individuals with longer credit histories and more experience managing debt. And all of that is before credit card interest rates — which have been increasing for most card holders as an indirect consequence of the Fed’s series of rate hikes the past year — means that a larger portion of consumers’ monthly payments are going toward interest instead of principal.

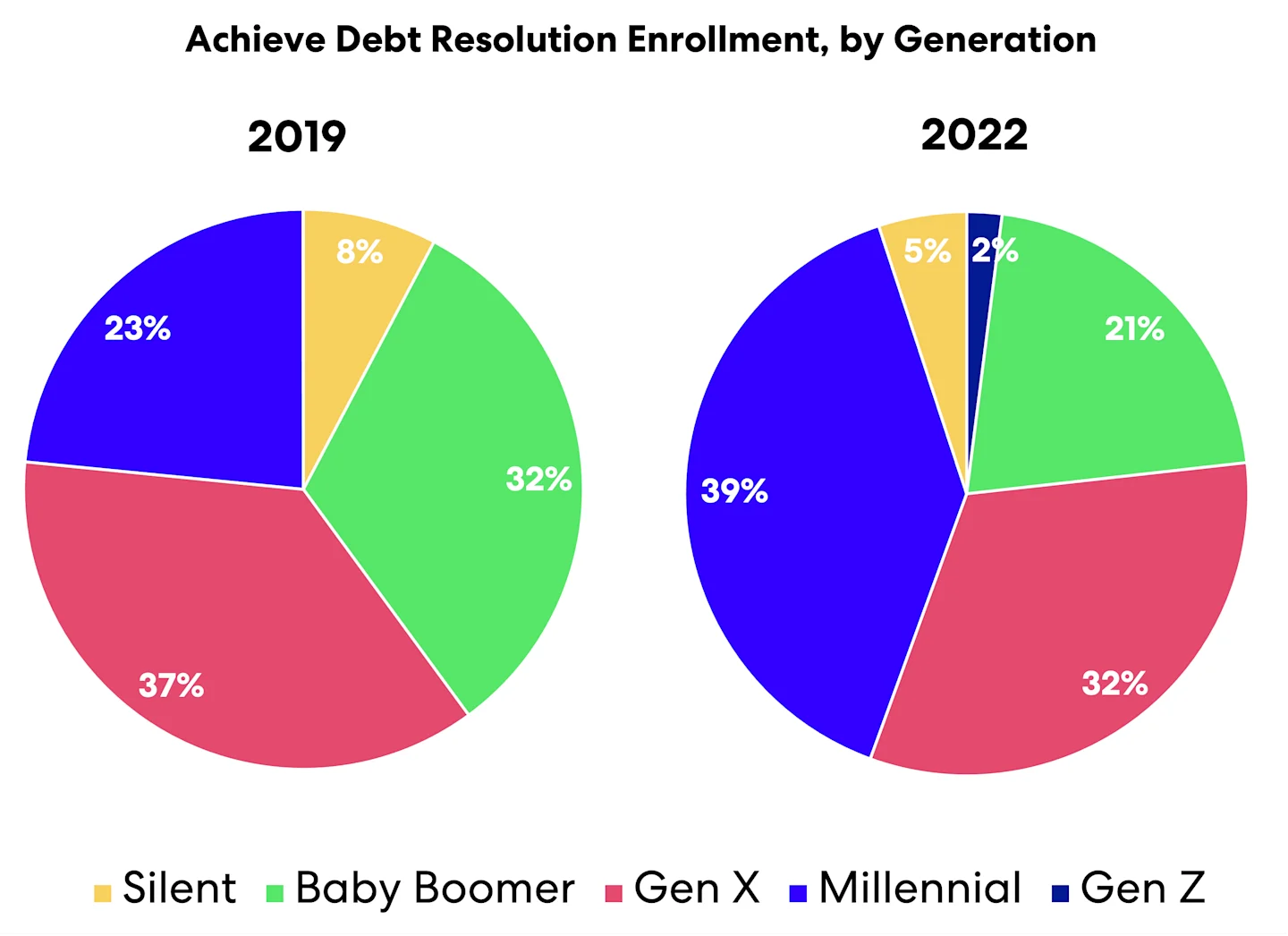

At Achieve, the story of our members mirrors that of the Fed’s credit card delinquency stats. In 2019, before the pandemic, Millennials accounted for 23% of Achieve’s debt relief members, with essentially no customers from the Gen Z demographic. In 2022, Millennials and Gen Z combined represented 44% of Achieve’s debt relief membership, while the share of Baby Boomer and Silent Generation members shrank from 40% in 2019 to 23% in 2022. Meanwhile, Gen X represented 32% of Achieve’s debt relief members in 2022, compared to 37% in 2019.

Part of this is the result of the overall aging of the American population. The oldest Millennials are now in their 40s, while the entire Baby Boomer generation will be 60 years or older by the end of next year. But it’s also important to consider the extent to which a hardship can set someone back in their financial journey when they’re already starting from a place of limited resources and few financial backstops.

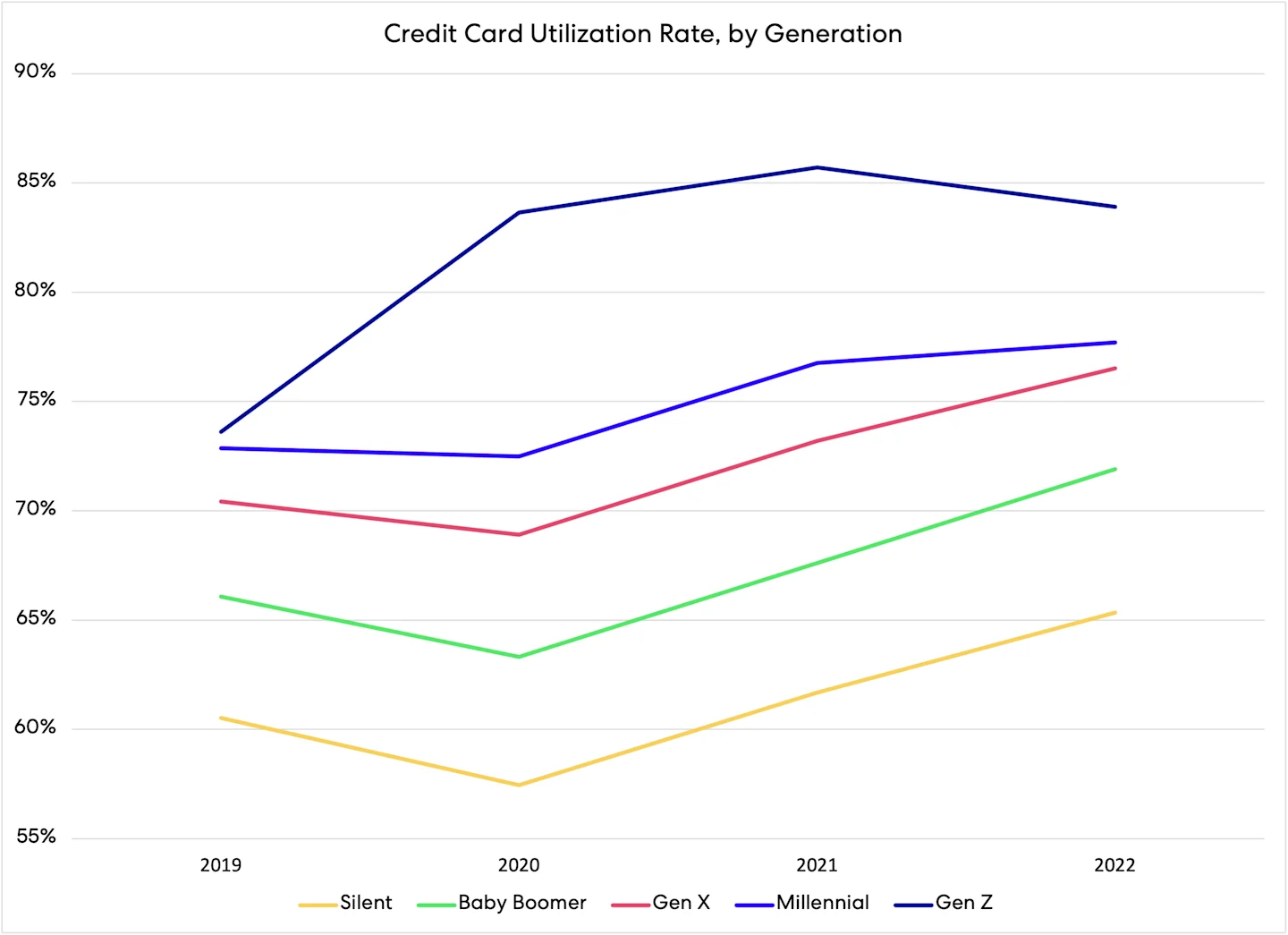

Millennials and Gen Z members who enroll in Achieve’s debt relief program also tend to have higher credit card utilization rates than older generations. This is partially due to younger consumers having lower credit limits and fewer overall credit tradelines. That’s also why the typical debt relief member from the two youngest generations enrolls a lower total amount of debt than older generations.

At Achieve, we’re doing what so many financial institutions aren’t: serving consumers who fall outside the easiest-to-manage credit boxes. While the traditional financial system and most consumer fintechs cater to those with pristine credit histories, we’ve been at the forefront of helping everyday Americans for over two decades. We’ve seen the ups and downs of multiple economic cycles and will help many weather this next wave. For tips and tricks to manage debt or create a budget, visit achieve.com/learn

Author Information

Written by

Analyst, Achieve Center for Consumer Insights

Related Articles

On the surface, the premise of Buy Now, Pay Later is simple and appealing. But borrowers who can’t afford to repay their BNPL loans risk getting hit with late fees, falling behind on other financial obligations, damaging their credit and other challenges.

With financial volatility on the rise, it’s time to rethink how people use mobile apps to manage their money

Household debt is at record levels and all that borrowing is taking a toll on Americans’ mental and physical health.